pvosng.ru

News

Colorado Refinance

Use the auto loan payment refinance calculator below and get rates lower than most dealers can match. We also have motorcycle and RV refinancing. To qualify for a bank statement loan in Colorado, prospective borrowers should provide at least 12 months of bank statements made up of monthly deposits. You. Use the mortgage refinance calculator to sort through a multitude of factors including your current interest rate, the new potential rate, closing costs and. An auto loan refinance might be a good fit if you qualify for a lower interest rate or repayment terms that meet your financial goals. Since Credit Union of. As of Thursday, September 12, , current interest rates in Colorado are % for a year fixed mortgage and % for a year fixed mortgage. Apply for a Cash-Out Refinance in Colorado Today. If you qualify for a cash-out refinance, you could be closer than you think to getting the funds you need for. Applying for a mortgage refinance in Colorado with Front Range Mortgage, you get pre-qualified in just one hour. To get started, please call () Whether it's for a new home purchase or a refinance, this option can help you finance up to 97% of the cost of a home and the renovations that come with it. Community Banks of Colorado's Mortgage Bankers have the experience to help walk you through your mortgage refinancing options. Use the auto loan payment refinance calculator below and get rates lower than most dealers can match. We also have motorcycle and RV refinancing. To qualify for a bank statement loan in Colorado, prospective borrowers should provide at least 12 months of bank statements made up of monthly deposits. You. Use the mortgage refinance calculator to sort through a multitude of factors including your current interest rate, the new potential rate, closing costs and. An auto loan refinance might be a good fit if you qualify for a lower interest rate or repayment terms that meet your financial goals. Since Credit Union of. As of Thursday, September 12, , current interest rates in Colorado are % for a year fixed mortgage and % for a year fixed mortgage. Apply for a Cash-Out Refinance in Colorado Today. If you qualify for a cash-out refinance, you could be closer than you think to getting the funds you need for. Applying for a mortgage refinance in Colorado with Front Range Mortgage, you get pre-qualified in just one hour. To get started, please call () Whether it's for a new home purchase or a refinance, this option can help you finance up to 97% of the cost of a home and the renovations that come with it. Community Banks of Colorado's Mortgage Bankers have the experience to help walk you through your mortgage refinancing options.

To qualify for a bank statement loan in Colorado, prospective borrowers should provide at least 12 months of bank statements made up of monthly deposits. You. Get some or all of your closing costs paid when you take a slightly higher interest rate.» Start the process now conventional loan, refinance a VA loan, or FHA. Want to refinance your home loan? Purchase · Home Refinancing · Home Buyer Mortgage Solutions. The mortgage rates in Colorado are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of September A Home Refinance Loan 1 from Vectra Bank can shorten your mortgage term. That, in turn, can lower the amount of interest paid over the life of your loan. Use the mortgage refinance calculator to sort through a multitude of factors including your current interest rate, the new potential rate, closing costs and. We are a full service mortgage company based in Parker, CO. We specialize in Wholesale Mortgage and Refinance Rates in Parker and Castle Rock & Lonetree. RFP Conduct the Colorado Property Assessment Study (submit by pm, 9/13/). Home · Interim Schedule · Bills · Find A Bill · All Bills · All Bills. CHFA's mission is to strengthen Colorado by investing in affordable housing and community development. We were created in by the Colorado General Assembly. Craft the right auto loan for your Colorado vehicle refinance. Stop losing $ On Vehicle Loans. Refi and Get $ Cash Back. Same Vehicle, Lower Payment. The current average year fixed refinance rate rose to %. Colorado's rate of % is 8 basis points higher than the national average of %. Today's. CHFA's mission is to strengthen Colorado by investing in affordable housing and community development. We were created in by the Colorado General Assembly. Compare today's average mortgage rates in the state of Colorado, based on an aggregated pool of rates from multiple sources. If you are thinking of mortgage refinancing in Denver, CO, give us a call at and a member of our knowledgeable and friendly team can discuss. MORTGAGE LOANS. At Elevations, we know Colorado mortgages. Whether you want to buy a house or build one, refinancing your mortgage or invest in. MORTGAGE LOANS. At Elevations, we know Colorado mortgages. Whether you want to buy a house or build one, refinancing your mortgage or invest in. Get low car rates and pay off your vehicle faster with Partner Colorado Credit Union's auto loan refinancing options in Denver, CO. Learn more online. We have partnered with LendKey® to help consolidate your student loans for one easy payment and could help pay off your loans faster! Serving Colorado. You'll get some of the most competitive mortgage rates in Colorado with us. As a credit union we're able to offer more competitive interest rates and lower. You'll get some of the most competitive mortgage rates in Colorado with us. As a credit union we're able to offer more competitive interest rates and lower.

Income Generating Ideas

Investing in rental properties can generate significant passive income but requires a substantial upfront investment. Once you own a rental property, you can. Ever heard of earning money while you sleep? That's what affiliate marketing can do for you. It's a proven way to earn passive income, especially if done right. I've found a few ideas that still seems promising, such as starting a podcast, selling online courses, or creating an app. Idea 2: Mutual Funds Investing in mutual funds is one of the best ways to generate passive income. You can choose mutual funds based on your risk appetite and. Passive income ideas · 1. Earn royalties on your photos or artwork · 2. Design printables or templates · 3. Create a website or blog · 4. Rent out a spare room or. Passive income is any money earned in a manner that does not require too much effort. There are several passive income-generating ideas that require a lot of. High-interest savings accounts, investing in business, P2P lending, and rental properties are some ways to generate passive income. One of the most popular passive income business ideas in the modern age is podcasting. Speak directly to your audience about topics important to you, and earn. Learn about the benefits of earning passive income 28 ways to earn passive income as a college student. Here are 28 ideas for earning passive income as a. Investing in rental properties can generate significant passive income but requires a substantial upfront investment. Once you own a rental property, you can. Ever heard of earning money while you sleep? That's what affiliate marketing can do for you. It's a proven way to earn passive income, especially if done right. I've found a few ideas that still seems promising, such as starting a podcast, selling online courses, or creating an app. Idea 2: Mutual Funds Investing in mutual funds is one of the best ways to generate passive income. You can choose mutual funds based on your risk appetite and. Passive income ideas · 1. Earn royalties on your photos or artwork · 2. Design printables or templates · 3. Create a website or blog · 4. Rent out a spare room or. Passive income is any money earned in a manner that does not require too much effort. There are several passive income-generating ideas that require a lot of. High-interest savings accounts, investing in business, P2P lending, and rental properties are some ways to generate passive income. One of the most popular passive income business ideas in the modern age is podcasting. Speak directly to your audience about topics important to you, and earn. Learn about the benefits of earning passive income 28 ways to earn passive income as a college student. Here are 28 ideas for earning passive income as a.

Once you've set up your online business, you can earn passive income through sales, ads, or commissions. It takes some effort to start, but the earning. If you have a spacious and beautiful backyard, why not turn it into an income-generating space? You can rent it out for events such as weddings, birthday. 25 Ways To Make Passive Income in · Rent all or part of your property · Store stuff for people · Rent out items for people to use · Bonds and bond funds · Put. If you're looking for passive income ideas, one that has worked for me is selling digital products on Opuna. I started by creating some AI-. If you have no problem in sharing your idea please share it with us in the comment section. Seeking Advice/Help. Hey there! Are you earning. Investing in rental properties is an excellent way to generate a steady passive income. As a property owner, you stand to gain from monthly rental payments and. Buying and selling blogs can be a great way to generate passive income. Whether that is a dormant blog that you coax back into life, or a thriving blog with an. Explore several ideas that can help generate passive income and grow your portfolio. · High-Yield Savings Account: Not glamorous, but it's low-risk. · Royalties. generating revenue through lease Most successful passive income strategies are built on years of effort, learning, and refining ideas. Passive income apps allow you to generate small amounts of passive income throughout the year. Unlike sharing economy apps such as Airbnb and Neighbor, many. Passive income ideas · 1. Earn royalties on your photos or artwork · 2. Design printables or templates · 3. Create a website or blog · 4. Rent out a spare room or. Learn about the benefits of earning passive income 28 ways to earn passive income as a college student. Here are 28 ideas for earning passive income as a. Generally speaking, you'll need one of two things to start earning passive income: time or money. Sure, passive income can eventually provide you with extra. Passive income apps allow you to generate small amounts of passive income throughout the year. Unlike sharing economy apps such as Airbnb and Neighbor, many. There are 9 key strategies that I recommend you focus on to get better results and generate more income in your business. idea of generating income in more than one way," he said. These six options are just a few ideas for how to earn money from more than one source. 1. Consult. Tree planting an income generating activity, where GBM gives a financial compensation (US 10 cents) to nursery groups for every tree seedling that is planted. Another way to generate revenue from your writing or other creative work is to sell it through a membership site. With this type of site, visitors pay you a. 11 Best Passive Income Ideas · 1. Dividend investing. As a dividend investor, you purchase stocks that share earnings with shareholders by way of dividend. If you have a spacious and beautiful backyard, why not turn it into an income-generating space? You can rent it out for events such as weddings, birthday.

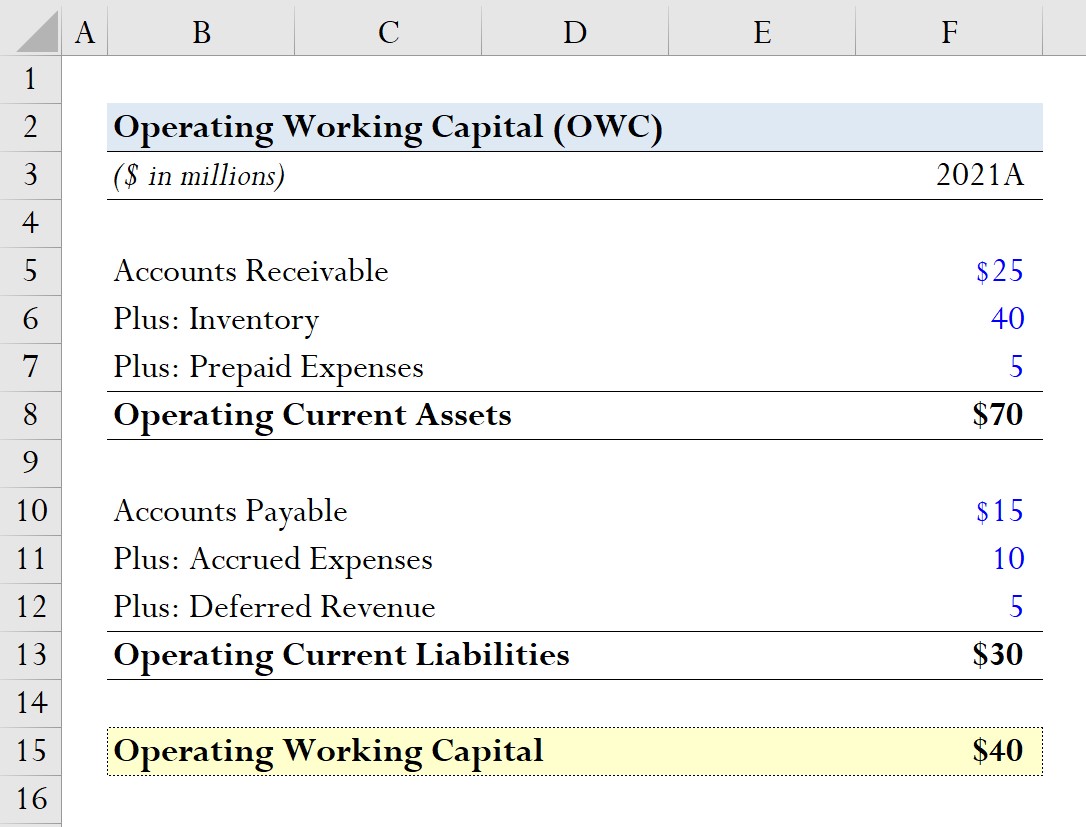

How To Obtain Working Capital

Alternatively, you can calculate a working capital ratio. This is done simply by dividing total current assets by total current liabilities, to get a ratio such. How To Calculate Non-Cash Working Capital Using 2 Formulas · Non-cash working capital = current assets without cash – current liabilities · Non-cash working. They may include flexible repayment to protect the company's working capital, such as structuring payments to go up or down based on your cash flow, paying off. Do you know how to determine the working capital requirement of your business? Read to find out more about working capital now! MD CAP encourages banks and other financial institutions to make loans to small businesses that have difficulty obtaining financing. If you own a small business. Working Capital Loans can be used to enhance your cash flow requirements from spreading the cost of your Corporation tax liability to covering the cost of. The simple and most common way to calculate working capital, also known as net working capital, is to divide current assets by current liabilities. The result. How do you apply for a working capital loan? · Fill out an online application quickly or call us directly to speak to a loan specialist. · We'll gather the. Working capital is the fuel that keeps your company's finances running. In accounting terms, it is current liquid assets - such as cash, inventories and. Alternatively, you can calculate a working capital ratio. This is done simply by dividing total current assets by total current liabilities, to get a ratio such. How To Calculate Non-Cash Working Capital Using 2 Formulas · Non-cash working capital = current assets without cash – current liabilities · Non-cash working. They may include flexible repayment to protect the company's working capital, such as structuring payments to go up or down based on your cash flow, paying off. Do you know how to determine the working capital requirement of your business? Read to find out more about working capital now! MD CAP encourages banks and other financial institutions to make loans to small businesses that have difficulty obtaining financing. If you own a small business. Working Capital Loans can be used to enhance your cash flow requirements from spreading the cost of your Corporation tax liability to covering the cost of. The simple and most common way to calculate working capital, also known as net working capital, is to divide current assets by current liabilities. The result. How do you apply for a working capital loan? · Fill out an online application quickly or call us directly to speak to a loan specialist. · We'll gather the. Working capital is the fuel that keeps your company's finances running. In accounting terms, it is current liquid assets - such as cash, inventories and.

So, working capital equals money your business can access/ is owed minus its debts. You can still obtain a working capital loan with bad credit. We know that. The PayPal Working Capital business loan is primarily based on your PayPal account history. Apply for $1, to $, (and up to $, for repeat. Business Administration SBA. Export Working Capital Financing enables U.S. businesses to obtain loans that facilitate the export of goods or services by. Working capital, defined as current assets minus current liabilities, is a fundamental resource for every business. It's used to meet short-term financial. Working capital, or operating capital, is the amount of cash available to a business after deducting all operational expenses. In effect, the working capital is. You are a French exporter and you need a working capital loan for your export contracts. You would like to obtain working capital loans from French banks. If you meet the eligibility criteria, then you may receive an offer to apply for funding. You can also check for offers in the Finance page of your Shopify. Business PayPal account. Pay off any existing PayPal Working Capital loan. What materials do I need to apply for PayPal Working Capital? For many merchants. Working capital is usually defined to be the difference between current assets and current liabilities. However, we will modify that definition when we measure. Working capital requirement (commonly called WCR) is an essential financial indicator for all businesses. It measures the difference between the resources. You can find your business' working capital by deducting the current liabilities from current assets. Current Assets include cash on hand, accounts receivable. In this way, working capital loans are simply corporate debt borrowings that are used by a company to finance its daily operations. Key Takeaways. A working. A working capital loans is a type of short-term loan offered by a bank or alternative lender to finance a company's everyday operations. Flexible financing for large contracts. · More attractive advance rates than conventional financing. · Obtain the line of credit quickly from a qualified lender. Working capital, itself, is the difference between a small business's current assets minus their current liabilities. Ideally, a company would like to see their. This involves refinancing your existing equipment loans and using the equity in that equipment to obtain working capital. Your equipment will work for you, and. Working capital fund; Professional fees. Every application is studied by the It may be considered a personal investment, to help you obtain financing from. Bank loans: Traditional bank loans are one of the most common methods of obtaining financing for working capital. Businesses can apply for a loan from a bank. Where can I get working capital financing? Working capital financing is offered by a variety of banks, non-bank lenders, and finance companies. When you. This may require a firm to calculate its working capital every day. The frequency of working capital calculations depends on many factors, including the.

Best Way To Transfer Credit Card Balance

Choose one or more cards with the highest rates and transfer those balances first, if the new credit limit permits. · Read the small print and note the balance. 1. Check your credit score. · 2. Shop for a credit card. · 3. Apply for the credit card. · 4. Begin the balance transfer. How to decide if a credit card balance transfer is right for you, where to look for one, and the steps to take to complete the process. Some cards have zero balance transfer fees, but the cards with the longest promotional periods usually have fees. How much can you save with a balance transfer? Bank of America has credit cards that offer low intro APRs on qualifying balance transfers for those looking to manage one card while paying down credit card. The simplest way to initiate a balance transfer is during the new account opening process or through your existing online credit card account. During the. + Show Summary · Citi Simplicity® Card · Wells Fargo Reflect® Card · Citi® Diamond Preferred® Card · Blue Cash Everyday® Card from American Express. Find out if a balance transferFootnote 1 is right for you. You could pay How long would the balance transfer take to post to my credit card account? Make sure you pay off your balance before the introductory offer runs out. If not, you could lose any low promotional rates you might have and be charged at a. Choose one or more cards with the highest rates and transfer those balances first, if the new credit limit permits. · Read the small print and note the balance. 1. Check your credit score. · 2. Shop for a credit card. · 3. Apply for the credit card. · 4. Begin the balance transfer. How to decide if a credit card balance transfer is right for you, where to look for one, and the steps to take to complete the process. Some cards have zero balance transfer fees, but the cards with the longest promotional periods usually have fees. How much can you save with a balance transfer? Bank of America has credit cards that offer low intro APRs on qualifying balance transfers for those looking to manage one card while paying down credit card. The simplest way to initiate a balance transfer is during the new account opening process or through your existing online credit card account. During the. + Show Summary · Citi Simplicity® Card · Wells Fargo Reflect® Card · Citi® Diamond Preferred® Card · Blue Cash Everyday® Card from American Express. Find out if a balance transferFootnote 1 is right for you. You could pay How long would the balance transfer take to post to my credit card account? Make sure you pay off your balance before the introductory offer runs out. If not, you could lose any low promotional rates you might have and be charged at a.

A balance transfer is a way of moving the balance from one credit card to another to pay down debt. The new card typically comes with a promotional, low or. Under the right circumstances, balance transfer credit cards may help you save money on interest payments. They can also simplify your repayment process and. Some cards have zero balance transfer fees, but the cards with the longest promotional periods usually have fees. How much can you save with a balance transfer? How does a balance transfer card work? Some credit cards that offer balance transfers provide new cardholders a 0% annual percentage rate (APR) during an. Move your debt to a balance transfer card that offers no interest for up to 20 months, you can save a large chunk of money and pay off your credit card faster. Step one: Apply for a balance transfer credit card or take advantage of a balance transfer offer on a credit card you already have. · Step two: Request the. A balance transfer involves moving the debt from one or more credit card accounts to a different credit card. This way, you can focus on what you still owe. Get more flexibility with a credit card balance transfer · Pay off credit cards with higher interest rates · Consolidate balances to make managing payments easier. Online banking: Choose Account services, then select Balance transfer from the "Payments" section. U.S. Bank Mobile App: Choose Manage, then select Transfer a. The next best solution would be to apply for a Citi flex loan or personal loan. Rates are in the % right now and that would knock off 35%. Balance transfers allow you to move debt from an existing credit card account to a new card at a lower interest rate. Most credit card companies charge fees. Balance transfer credit cards · Citi Simplicity® Card · Citi Simplicity® Card · Intro balance transfer APR · Regular balance transfer APR · Balance transfer fee. Transfer your existing credit card balance(s) with the highest interest rates first, if your new credit limit allows · Be sure to note any balance transfer fees. Get more flexibility with a credit card balance transfer · Pay off credit cards with higher interest rates · Consolidate balances to make managing payments easier. A balance transfer moves a balance from a credit card or loan to another credit card. Transferring balances with a higher annual percentage rate (APR) to a. One option for relief is a balance transfer. It won't eliminate your credit card debt, but it can effectively pause your interest charges so you have more. Carrying credit card balances every month? A balance transfer lets you move debt from one account to another to save money on interest charges. 1. Take Stock. There are some key questions you should ask yourself to evaluate your reasons for wanting a balance transfer. · 2. Check Your Credit Score. Take a. A balance transfer moves the balance from one type of debt to a credit card that has a 0% intro APR or a low APR rate.

2 3 4 5 6