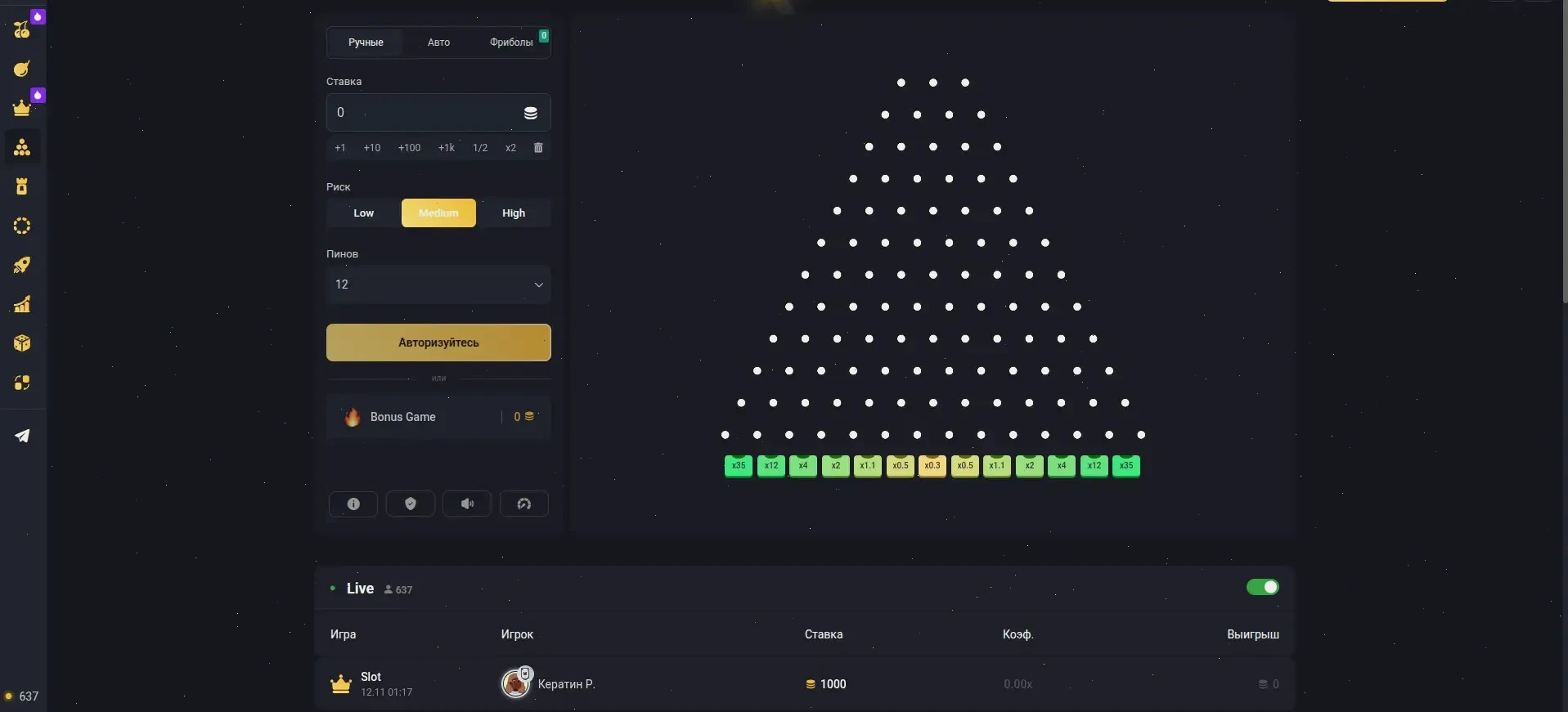

Хани Мани казино — официальный сайт и бонусы

Зеркало, вход и регистрация за минуту. Начните играть в слоты с щедрым приветственным пакетом прямо сейчас. Высокие коэффициенты, мгновенные выплаты — проверено игроками.

Игровые автоматы — наша основа

Выбирайте из сотен видеослотов. Тематика: мифология, приключения, фрукты, классика.

| Год основания платформы | 2022 |

| Лицензия регулятора | Кюрасао № 1668/JAZ |

| Минимальный депозит для игры | 500 RUB |

| Среднее время выплаты | 15 минут - 3 часа |

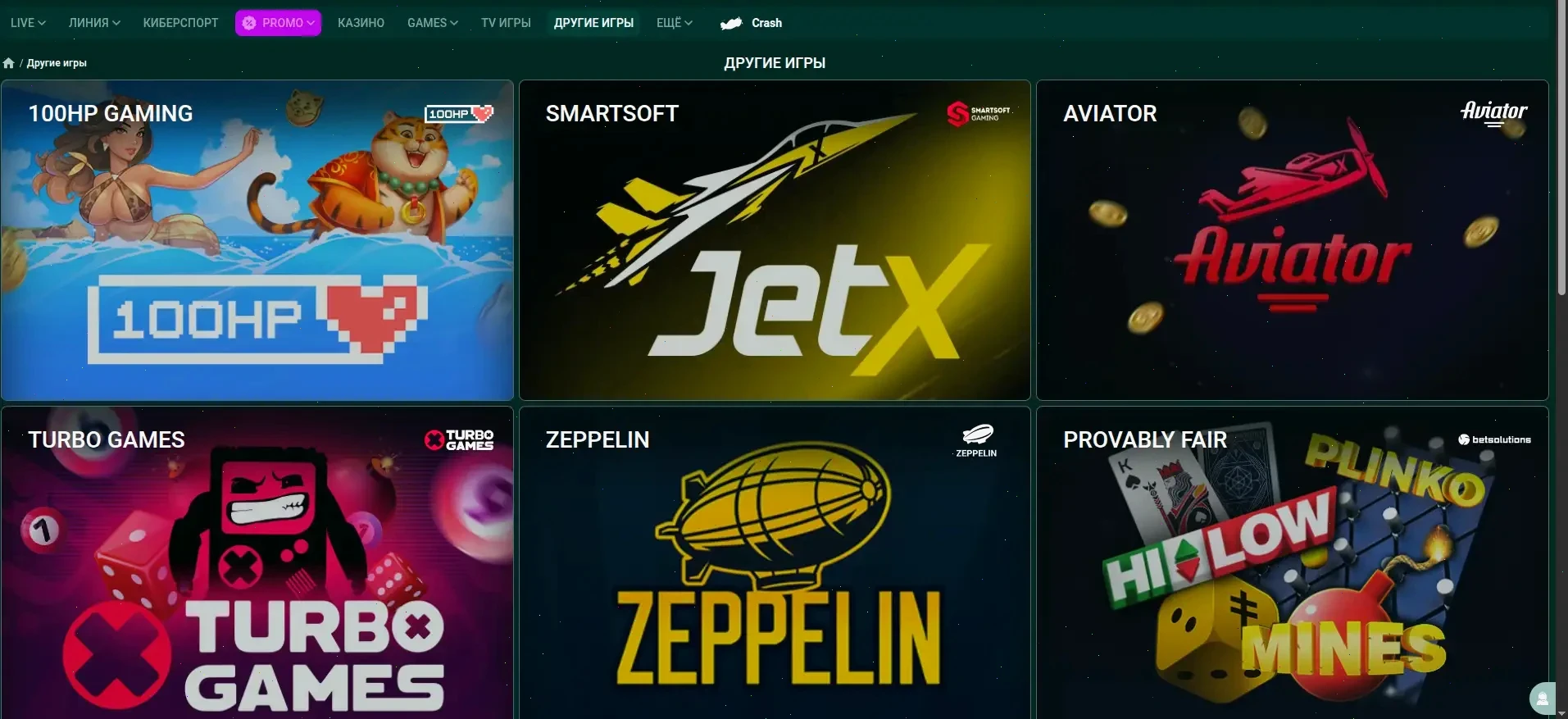

| Количество провайдеров | Более 80 |

| Вейджер приветственного бонуса | х35 |

| Поддержка 24/7 | Чат, email, телефон |

Бонусная политика — где щедрость?

Приветственный пакет — это отдельная история. Дают 100% на первый депозит и 50 фриспинов. Но это только начало. Второй депозит — 75%, третий — 50%. И так далее. Кажется, много? Это действительно так.

Но есть нюанс — отыграть. Вейджер х35 — это стандартно для рынка, но не для всех слотов. Читайте условия! Только определенные игры учитываются в отыгрыше. Обычно это слоты с высоким RTP. Кэшбэк каждую неделю — 10% от проигранной суммы. Без всяких условий. Просто возвращают на счет. Приятно.

Турниры... Их проводят постоянно. С призовыми фондами в несколько миллионов рублей. Нужно просто играть в указанные слоты и набирать очки. Лидеры получают крупные суммы. Реально крупные.

Технические моменты и безопасность

SSL-шифрование 256-bit — это обязательно. Все транзакции защищены. Личные данные тоже. Провайдеры игр — только лицензированные. Это гарантирует честность рандома. Никаких манипуляций с RTP.

Мобильная версия — это просто клон десктопного сайта. Все функции на месте. Ничего не обрезано. Работает в любом браузере. Загрузка быстрая, даже на слабом интернете. Удобно.

Пополнение: карты, электронные кошельки, криптовалюты. Вывод — на те же реквизиты. Есть лимиты: минимум 1000 рублей на вывод, максимум 600 000 рублей в месяц для новых игроков. После верификации лимиты повышаются.

Что говорят игроки?

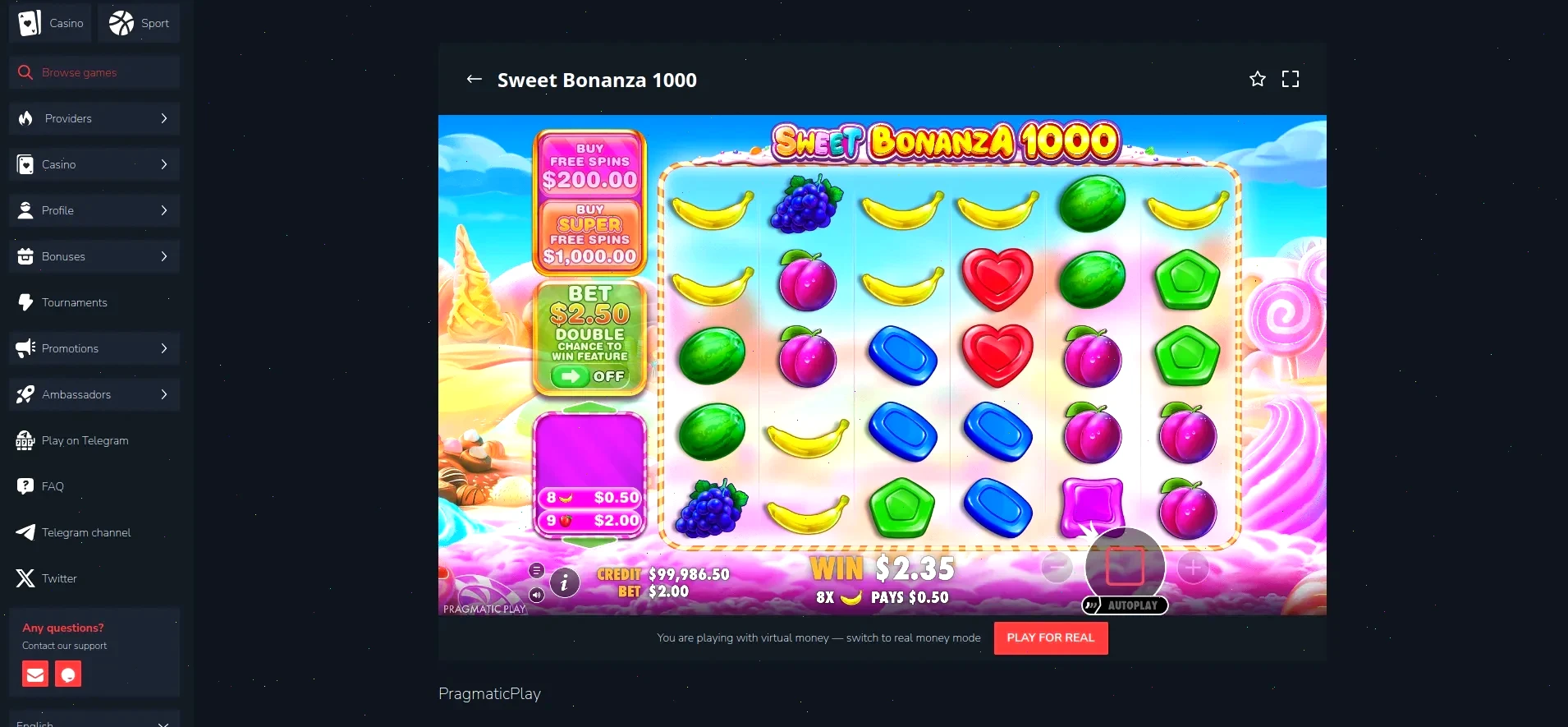

Вывел 45 тысяч без проблем. Поддержка ответила за 2 минуты, деньги пришли через час. Играю в основном в слоты от Pragmatic, здесь их полная коллекция.

Бонусы затягивают. Сначала показалось, что не отыграю, но фриспины отыгрались с лихвой. Мобильная версия — огонь, можно в любом месте крутить.

Остались вопросы?